The Ultimate Guide to Budgeting for Home Repairs: Maximizing Profit on Your Sale

Whether you’re a seasoned homeowner or preparing to sell your beloved property, one thing is certain – repairs and maintenance are an essential part of homeownership, especially if your property has special conditions such as fire damages. In that case, can you really sell my fire damaged house? Fortunately, yes. But how do you prioritize these repairs without breaking the bank? How can you ensure that every dollar spent on home improvements will increase the value of your home when it’s time to sell? Fear not, because in this comprehensive guide, we’ll walk you through all the steps needed to budget effectively for those necessary repairs.

Researching Costs

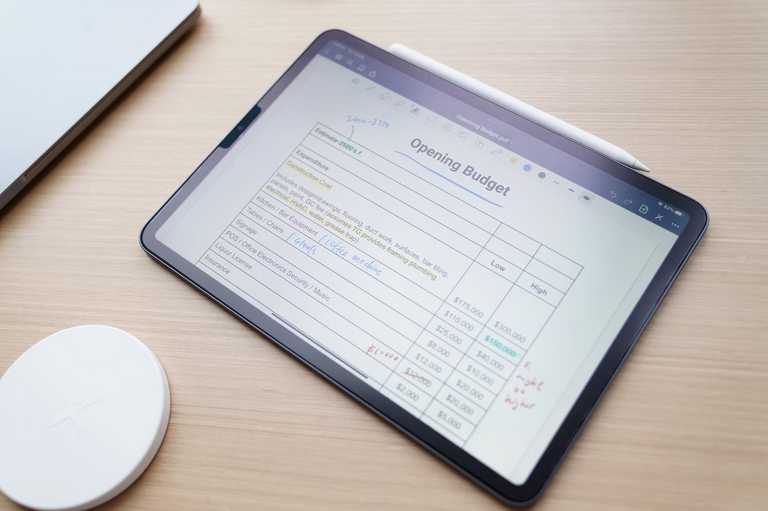

When budgeting for home repairs, it’s essential to research and gather accurate cost estimates for the necessary work. Reach out to multiple contractors or service providers to obtain quotes for the repairs and improvements you plan to make. Ask for detailed breakdowns of materials, labor, and any additional expenses. Additionally, consider the timeframe for completion and any potential cost overruns to ensure you have a realistic estimate of the total expenses.

Prioritizing Repairs

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal.

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal.

Comparing DIY Versus Professional Services

Another factor to consider is whether to tackle certain repairs yourself or hire professional services. While DIY projects can help save money, it’s important to assess your skills, availability, and the complexity of the repairs. Some tasks may require specialized knowledge or licensing, and attempting them without proper expertise can lead to costly mistakes.

Setting a Contingency Budget

When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

Budgeting for home repairs is a crucial step in maximizing your profit on the sale of your home. By prioritizing repairs, researching costs, weighing DIY versus professional services, and setting a contingency budget, you can effectively allocate your resources and ensure a profitable outcome.…

Read More

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

One of the biggest risks facing

One of the biggest risks facing  Bitcoin is currently facing a major problem with

Bitcoin is currently facing a major problem with  Bitcoin’s price is still highly volatile, which presents a major risk for investors. While the cryptocurrency has seen its price increase dramatically in recent months, it has also experienced several sudden and sharp drops. This volatility makes it difficult to predict how Bitcoin will perform in the future and makes it a risky investment. Another big risk for Bitcoin is its lack of regulation. Because any government or financial institution does not regulate Bitcoin, there is a lot of uncertainty surrounding it. This could lead to problems in the future if the value of Bitcoin suddenly drops or if there are hacks or scams associated with it.

Bitcoin’s price is still highly volatile, which presents a major risk for investors. While the cryptocurrency has seen its price increase dramatically in recent months, it has also experienced several sudden and sharp drops. This volatility makes it difficult to predict how Bitcoin will perform in the future and makes it a risky investment. Another big risk for Bitcoin is its lack of regulation. Because any government or financial institution does not regulate Bitcoin, there is a lot of uncertainty surrounding it. This could lead to problems in the future if the value of Bitcoin suddenly drops or if there are hacks or scams associated with it.

When looking for a suitable mortgage advisor, it is good to begin by asking family, friends, or people who have recently purchased a home. You do not have to work with the same person they did. However, it can give you an idea of the experience of working with an advisor and the kind of qualities to look for.

When looking for a suitable mortgage advisor, it is good to begin by asking family, friends, or people who have recently purchased a home. You do not have to work with the same person they did. However, it can give you an idea of the experience of working with an advisor and the kind of qualities to look for.