Understanding Exchange Rates: How They Affect Your International Money Transfers

When it comes to sending money abroad, exchange rates play a pivotal role in determining how much your recipient will actually receive. Understanding how these rates work can help you make smarter decisions and get the most out of your international money transfers. Let’s dive into the world of exchange rates and explore how they can impact your transactions in a simple and easy-to-understand way.

What Are Exchange Rates?

At its core, an exchange rate is the value of one currency compared to another. For example, if you send money to UK from USA, you’ll need to convert U.S. dollars (USD) into British pound sterling (GBP). The exchange rate tells you how much one dollar is worth in euros at that moment in time. Exchange rates fluctuate constantly due to various factors like economic conditions, interest rates, and market demand for currencies.

Why Exchange Rates Matter in International Money Transfers

When you send money internationally, the exchange rate determines how much your currency is worth in the destination country’s currency. Even small differences in exchange rates can have a significant impact on the final amount received.

Example:

Let’s say you want to send $1,000 to a friend in the U.K.

Exchange Rate A:** 1 USD = 0.75 GBP

– Your friend receives £750.

Exchange Rate B:** 1 USD = 0.70 GBP

– Your friend receives £700.

As you can see, a slight change in the exchange rate results in your friend receiving £50 less.

Factors That Influence Exchange Rates

Several factors can cause exchange rates to fluctuate:

- Economic Indicators: Countries with strong economic performance typically have stronger currencies. Indicators like GDP growth, employment rates, and inflation influence a currency’s value.

- Interest Rates: Higher interest rates often attract foreign investments, which increases demand for that currency and raises its value.

- Political Stability: Countries with stable governments and predictable policies tend to have stronger currencies. Political instability or uncertainty can cause a currency to depreciate.

- Market Demand: The demand for a currency in the global market can also affect its value. High demand increases a currency’s value, while low demand can lead to depreciation.

How to Get the Best Exchange Rate

Getting a favorable exchange rate can make a big difference in the amount of money your recipient acquires. Here are some tips to help you get the best rate:

- Compare Rates Across Providers: Different money transfer services offer different exchange rates. Use comparison tools or check multiple providers to find the best rate.

- Monitor Exchange Rate Trends: If your transfer isn’t urgent, you might benefit from waiting for a more favorable exchange rate. Keep an eye on trends or use rate alerts to notify you when the rate hits your target.

- Avoid Hidden Fees: Some providers advertise low fees but offer less competitive exchange rates to make up the difference. Make sure to consider both fees and exchange rates when choosing a service.

- Consider Timing: Exchange rates can fluctuate throughout the day. If you notice a significant change, it might be worth timing your transfer accordingly.

The Role of Transfer Methods and Services

Different money transfer services offer various exchange rates and fees. Some common options include:

- Banks: Banks typically offer lower exchange rates compared to specialized money transfer services and may charge higher fees. However, they are reliable and secure.

- Online Money Transfer Services: Services often offer better exchange rates and lower fees than banks. They also tend to be faster and more convenient.

- Currency Brokers: For large transfers, currency brokers can offer competitive rates and personalized service. They cater to clients who regularly make large international transfers.

In Conclusion

Exchange rates are a key factor in international money transfers, and understanding how they work can help you make more informed decisions. By keeping an eye on rates, comparing providers, and being mindful of fees, you can maximize the amount your recipient receives and avoid any unpleasant surprises. The world of currency exchange may seem complex, but with a bit of knowledge, you can navigate it with confidence and make the most of your money transfers.…

Read More

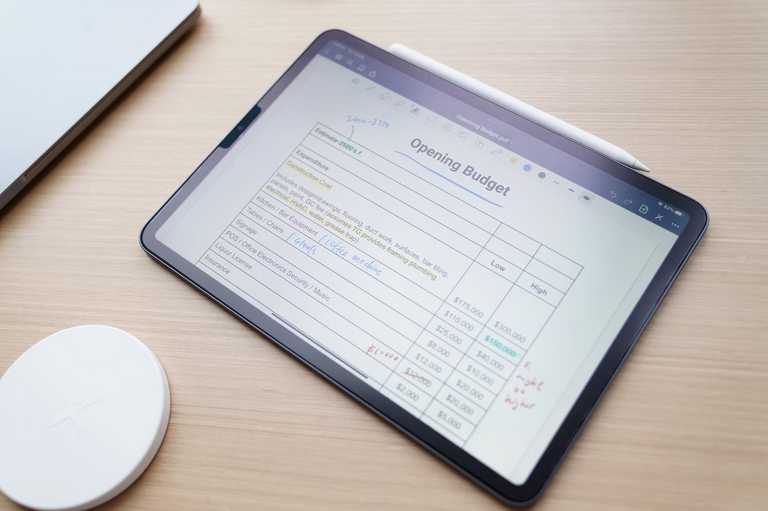

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal.

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal. When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

Understanding your Explanation of Benefits (EOB) is crucial when negotiating medical bills. An EOB is a document that explains how much your healthcare provider charged you, what your insurance covered, and what you’re responsible for paying. It’s a must to carefully review this document so you can pinpoint any errors or discrepancies. Also, keep an eye out for any duplicate charges or overbilling. Healthcare providers sometimes make mistakes and charge patients twice for the same service, which can add up quickly if not caught early on.

Understanding your Explanation of Benefits (EOB) is crucial when negotiating medical bills. An EOB is a document that explains how much your healthcare provider charged you, what your insurance covered, and what you’re responsible for paying. It’s a must to carefully review this document so you can pinpoint any errors or discrepancies. Also, keep an eye out for any duplicate charges or overbilling. Healthcare providers sometimes make mistakes and charge patients twice for the same service, which can add up quickly if not caught early on. We all know that prescription drugs can make up such a huge portion of expenses. Unfortunately, not all prescription drugs are covered by insurance plans or government programs. This is where steep discounts for uncovered prescription drugs come in. Pharmaceutical companies and drug manufacturers often have patient assistance programs that offer discounts on their products for individuals who cannot afford them.

We all know that prescription drugs can make up such a huge portion of expenses. Unfortunately, not all prescription drugs are covered by insurance plans or government programs. This is where steep discounts for uncovered prescription drugs come in. Pharmaceutical companies and drug manufacturers often have patient assistance programs that offer discounts on their products for individuals who cannot afford them.

To succeed in forex trading, you need a well-thought-out plan. The first step is determining your goals and objectives – what do you hope to achieve through trading? Are you looking for short-term gains or long-term investments? Next, you should establish a clear strategy for entering and exiting trades. This includes setting stop-loss orders to limit potential losses and take-profit orders to lock in profits. It’s also important to decide on the types of currency pairs you want to trade and the timeframes that work best for your schedule. Consider these decisions, such as volatility, liquidity, and market trends.

To succeed in forex trading, you need a well-thought-out plan. The first step is determining your goals and objectives – what do you hope to achieve through trading? Are you looking for short-term gains or long-term investments? Next, you should establish a clear strategy for entering and exiting trades. This includes setting stop-loss orders to limit potential losses and take-profit orders to lock in profits. It’s also important to decide on the types of currency pairs you want to trade and the timeframes that work best for your schedule. Consider these decisions, such as volatility, liquidity, and market trends.

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

It is essential to know how much your gold is worth and keep track of market trends so you can adjust your investments accordingly. There are a variety of resources that can help you track the value of gold, such as online calculators or websites. In conclusion, investing in gold is a great way to diversify your portfolio and protect your money. Make sure you understand the process and use these tips to get the most out of your investment. Research different options, know your risk tolerance, consider your objectives and invest in quality assets.…

It is essential to know how much your gold is worth and keep track of market trends so you can adjust your investments accordingly. There are a variety of resources that can help you track the value of gold, such as online calculators or websites. In conclusion, investing in gold is a great way to diversify your portfolio and protect your money. Make sure you understand the process and use these tips to get the most out of your investment. Research different options, know your risk tolerance, consider your objectives and invest in quality assets.…

One of the biggest risks facing

One of the biggest risks facing  Bitcoin is currently facing a major problem with

Bitcoin is currently facing a major problem with  Bitcoin’s price is still highly volatile, which presents a major risk for investors. While the cryptocurrency has seen its price increase dramatically in recent months, it has also experienced several sudden and sharp drops. This volatility makes it difficult to predict how Bitcoin will perform in the future and makes it a risky investment. Another big risk for Bitcoin is its lack of regulation. Because any government or financial institution does not regulate Bitcoin, there is a lot of uncertainty surrounding it. This could lead to problems in the future if the value of Bitcoin suddenly drops or if there are hacks or scams associated with it.

Bitcoin’s price is still highly volatile, which presents a major risk for investors. While the cryptocurrency has seen its price increase dramatically in recent months, it has also experienced several sudden and sharp drops. This volatility makes it difficult to predict how Bitcoin will perform in the future and makes it a risky investment. Another big risk for Bitcoin is its lack of regulation. Because any government or financial institution does not regulate Bitcoin, there is a lot of uncertainty surrounding it. This could lead to problems in the future if the value of Bitcoin suddenly drops or if there are hacks or scams associated with it.