The Ultimate Guide to Budgeting for Home Repairs: Maximizing Profit on Your Sale

Whether you’re a seasoned homeowner or preparing to sell your beloved property, one thing is certain – repairs and maintenance are an essential part of homeownership, especially if your property has special conditions such as fire damages. In that case, can you really sell my fire damaged house? Fortunately, yes. But how do you prioritize these repairs without breaking the bank? How can you ensure that every dollar spent on home improvements will increase the value of your home when it’s time to sell? Fear not, because in this comprehensive guide, we’ll walk you through all the steps needed to budget effectively for those necessary repairs.

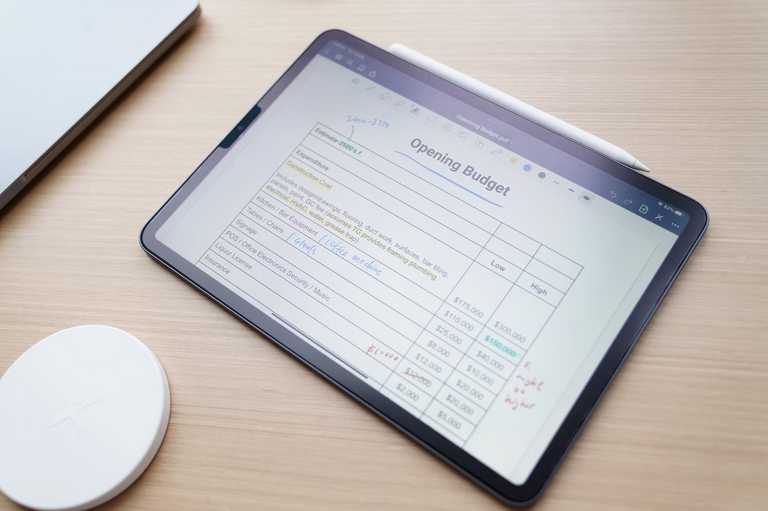

Researching Costs

When budgeting for home repairs, it’s essential to research and gather accurate cost estimates for the necessary work. Reach out to multiple contractors or service providers to obtain quotes for the repairs and improvements you plan to make. Ask for detailed breakdowns of materials, labor, and any additional expenses. Additionally, consider the timeframe for completion and any potential cost overruns to ensure you have a realistic estimate of the total expenses.

Prioritizing Repairs

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal.

The first step in budgeting for home repairs is prioritizing which repairs and improvements will have the most significant impact on your home’s value. Start by assessing the condition of your property and identifying any issues that may affect its appeal or safety. Focus on areas that potential buyers typically pay close attention to, such as the kitchen, bathrooms, flooring, and curb appeal.

Comparing DIY Versus Professional Services

Another factor to consider is whether to tackle certain repairs yourself or hire professional services. While DIY projects can help save money, it’s important to assess your skills, availability, and the complexity of the repairs. Some tasks may require specialized knowledge or licensing, and attempting them without proper expertise can lead to costly mistakes.

Setting a Contingency Budget

When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

When budgeting for home repairs, it’s wise to set aside a contingency budget. Unexpected issues or hidden repairs may arise during the renovation process, which can inflate your expenses. As a general rule of thumb, setting aside 10-20% of your total repair budget for contingencies is a prudent approach. This cushion will give you the flexibility to address unforeseen problems without compromising your profit potential.

Budgeting for home repairs is a crucial step in maximizing your profit on the sale of your home. By prioritizing repairs, researching costs, weighing DIY versus professional services, and setting a contingency budget, you can effectively allocate your resources and ensure a profitable outcome.…

Read More

Understanding your Explanation of Benefits (EOB) is crucial when negotiating medical bills. An EOB is a document that explains how much your healthcare provider charged you, what your insurance covered, and what you’re responsible for paying. It’s a must to carefully review this document so you can pinpoint any errors or discrepancies. Also, keep an eye out for any duplicate charges or overbilling. Healthcare providers sometimes make mistakes and charge patients twice for the same service, which can add up quickly if not caught early on.

Understanding your Explanation of Benefits (EOB) is crucial when negotiating medical bills. An EOB is a document that explains how much your healthcare provider charged you, what your insurance covered, and what you’re responsible for paying. It’s a must to carefully review this document so you can pinpoint any errors or discrepancies. Also, keep an eye out for any duplicate charges or overbilling. Healthcare providers sometimes make mistakes and charge patients twice for the same service, which can add up quickly if not caught early on. We all know that prescription drugs can make up such a huge portion of expenses. Unfortunately, not all prescription drugs are covered by insurance plans or government programs. This is where steep discounts for uncovered prescription drugs come in. Pharmaceutical companies and drug manufacturers often have patient assistance programs that offer discounts on their products for individuals who cannot afford them.

We all know that prescription drugs can make up such a huge portion of expenses. Unfortunately, not all prescription drugs are covered by insurance plans or government programs. This is where steep discounts for uncovered prescription drugs come in. Pharmaceutical companies and drug manufacturers often have patient assistance programs that offer discounts on their products for individuals who cannot afford them.

To succeed in forex trading, you need a well-thought-out plan. The first step is determining your goals and objectives – what do you hope to achieve through trading? Are you looking for short-term gains or long-term investments? Next, you should establish a clear strategy for entering and exiting trades. This includes setting stop-loss orders to limit potential losses and take-profit orders to lock in profits. It’s also important to decide on the types of currency pairs you want to trade and the timeframes that work best for your schedule. Consider these decisions, such as volatility, liquidity, and market trends.

To succeed in forex trading, you need a well-thought-out plan. The first step is determining your goals and objectives – what do you hope to achieve through trading? Are you looking for short-term gains or long-term investments? Next, you should establish a clear strategy for entering and exiting trades. This includes setting stop-loss orders to limit potential losses and take-profit orders to lock in profits. It’s also important to decide on the types of currency pairs you want to trade and the timeframes that work best for your schedule. Consider these decisions, such as volatility, liquidity, and market trends.

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

When it comes to investing, there is no one-size-fits-all approach. You need to find the right mix of investments that fits your unique circumstances.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

MLB teams have also begun to capitalize on digital initiatives such as online ticketing, e-commerce, and mobile apps. These are relatively new sources of revenue, but they are becoming increasingly important for franchises looking to maximize their income potential.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

One of the most significant advantages of using a hard money lender is getting approved quickly. Hard money lenders don’t have the same regulations or paperwork requirements as banks do so that they can process loan applications much faster. This makes it easy for business owners who need cash fast to get the money they need quickly and easily.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

Unlike banks, hard money lenders don’t require a credit check. It makes them an ideal option for business owners who may have a less-than-perfect credit score or don’t want to go through the hassle of applying for a bank loan. This can be especially useful if you need quick capital and don’t have time to wait for a bank loan.

It is essential to know how much your gold is worth and keep track of market trends so you can adjust your investments accordingly. There are a variety of resources that can help you track the value of gold, such as online calculators or websites. In conclusion, investing in gold is a great way to diversify your portfolio and protect your money. Make sure you understand the process and use these tips to get the most out of your investment. Research different options, know your risk tolerance, consider your objectives and invest in quality assets.…

It is essential to know how much your gold is worth and keep track of market trends so you can adjust your investments accordingly. There are a variety of resources that can help you track the value of gold, such as online calculators or websites. In conclusion, investing in gold is a great way to diversify your portfolio and protect your money. Make sure you understand the process and use these tips to get the most out of your investment. Research different options, know your risk tolerance, consider your objectives and invest in quality assets.…